Holiday rental scams are on the rise, isn’t it time the hospitality industry took some KYC lessons from financial services?

Renting apartments in the city, cottages in the country and boutique properties off the beaten track has never been easier, thanks to the increasing popularity of online marketplaces for holiday home rentals like VRBO or Airbnb.

Platforms like Airbnb offer a great way to discover communities and live among the locals, while enjoying the comfort and utilities of a house or apartment. With millions of properties available at the click of a button, booking a holiday home is simple, straightforward and incredibly convenient. The COVID-19 pandemic boosted the popularity of the holiday home rental market, as travelers opted for the privacy of vacation homes over heavily populated hotels.

For property owners, holiday rentals offer a high reward for a relatively low effort.

Little wonder then that the holiday home rental industry is projected to be worth US$82.78 billion by the end of 2022.

However, as is often the case, popularity comes with a price, and fraudsters have now turned to holiday rental companies as a new illicit business opportunity (see our overview page on vacation rental scam).

“Scammers don’t take the summer off” said New York Attorney General Letitia James earlier this year in a warning to property owners who rent out their holiday homes.

Scams continue to rise, due to lack of preventive measures.

The surge of holiday rental scams is not a surprise. In fact, the number of articles on how to avoid scams on Airbnb (among other platforms) have increased lately, indicating just how common those scams have become. Since this type of fraud can take many forms – from fake accommodation listings to fake websites – it is difficult to implement a completely foolproof set of actions to tackle holiday rental scams. However, a comprehensive KYC framework and user identification system is a great place to start. In fact, one of the simplest and most effective measures in tackling holiday rental scams are KYC checks.

While the larger online marketplaces may go that extra mile to try and guarantee the safety of its users, smaller platforms that focus on specific regions, or niche target markets, tend to have fewer screening and KYC mechanisms in place, which makes them prime targets for holiday rental scams. Other more general marketplaces and social media platforms that also feature home rental adverts and the ability to connect property owners with prospective holidaymakers rarely have adequate security measures, thereby putting the guests at risk.

On most platforms, it is currently quite easy to register under a false identity and pretend to be someone else. Also, as no document is required to verify ownership of a property, scammers will often take the details and images from legitimate adverts on one platform and replicate it on another.

Identify rental scams on the spot.

Holiday rental scams can be difficult to spot, and some travelers have learned this the hard way. In fact, scammers are only getting better and now know how to fly under the radar. From fake ads to dubious listings that give an inaccurate portrayal of the property and features, fraudsters now excel in crafting ingenious and elaborate scams. Nonetheless, property owners and consumers can protect themselves by following three warning signs to detect holiday rental scammers:

- Wiring money outside of the listing platform transaction process: To remain undetected, fake property owners will often encourage you to wire money outside official channels, under false pretenses. You should always stick to the platforms’ dedicated payment solutions, as they guarantee secure payments and sometimes money-back guarantees. Paying with credit cards is often the best approach, because they allow the user to dispute unauthorized charges. No customer should ever pay in cash or make a wire transfer. For platforms, being able to deter these attacks by monitoring conversations and flagging specific keywords between realtors and customers may offer a certain form of protection. In addition, acting quickly whenever there’s a report of suspicious activity could benefit the customer, and avoid uncomfortable situations like being left stranded in a foreign country without accommodation, or even robbed.

- Verifying the listed property exists: In some cases, the listing is well crafted and difficult to pinpoint as a fake. When in doubt, the user should always conduct his own due diligence. Conducting a reverse search on property images or cross-checking against available information (name of the listing, name of the realtor, location, pictures, description, price compared to market price) to confirm the authenticity of the advert can save the prospective holidaymaker from having their holiday ruined by discovering their dream rental is not what they expected, or losing money to a fake listing, or even getting their personal data stolen.

Property listing platforms can conduct various property and identity checks to confirm the rental home is indeed owned by the person posting the advertisement. - Reading reviews: It might seem silly, but customers do not always read reviews. In addition to them being an important source of information regarding the quality of a property and its hosts, reviews can also help to determine whether a listing is genuine or not. Properties with no reviews, or reviews that repeat similar phrases with poor grammatical syntax, are warning signs that should be taken into account. Vetting property owners through robust KYC checks can be instrumental in the fight against fake listings, as creating several accounts (once an account or listing is revealed to be fake) takes considerable time, effort and expenditure, thus making holiday rental scams less desirable and profitable.

Deterrence is key.

Identifying fraudsters in a reactive fashion is one thing but being able to deter them from conducting fraudulent activity in the first place is another. If common fraud patterns could be automatically flagged by listing platforms, this could actually help prevent holiday rental scams.

As an example, most banks now automatically alert their clients when a connection from an unknown IP address occurs in order to prevent fraud and theft. Although this could also prevent account takeovers and subsequent fraud in the holiday home rental industry, most platforms have not implemented this safeguard. Other technical indicators that could identify fraudulent activity include the use of a non-domestic phone number to register an account. A better screening and vetting process for both customers and realtors is much needed to efficiently combat fraudulent activities on rental services platforms.

Digital identity verification has been widely adopted by the regulated markets of banking and financial services, but it can also be used by online marketplaces for holiday home rentals.

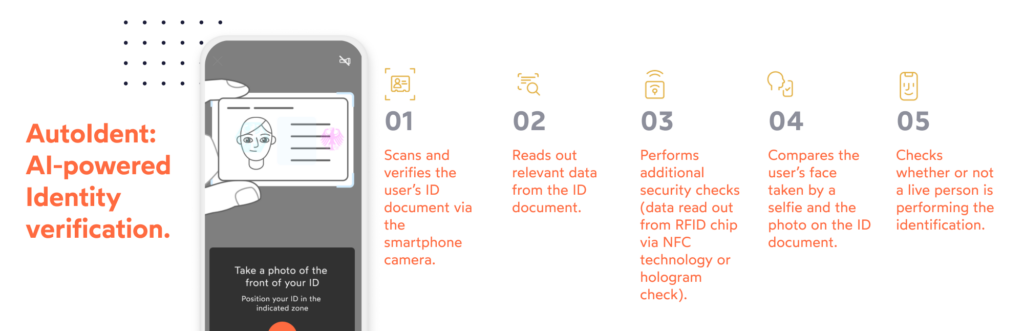

This makes the onboarding process for online rental portals quick and easy almost anywhere your clients go. The user captures his ID document with the camera of his mobile phone and then performs a short video selfie. The AutoIdent solution automatically proofs the document genuineness and compares the user’s biometrics from the selfie taken with the picture from the ID document. AutoIdent then automatically processes the data and confirms its authenticity, completely streamlining the onboarding process.

Transparent, efficient and painless for the user, AutoIdent is an ID verification solution that can be integrated easily into a mobile app through SDK, a web flow or directly through the IDnow AutoIdent application. As AutoIdent is highly customizable, it allows property listing platforms to define the rules and patterns for alerts. Using state-of-the-art artificial intelligence, IDnow guarantees users’ identities are thoroughly screened before using a service. Document verification of government-issued ID documents, biometric verification and liveness detection all ensure that holidaymakers and property owners can transact in confidence.

IDnow’s identity proofing methods have been optimized to meet the strictest security standards and regulatory requirements without compromising on customer conversions or the consumer experience. KYC has already tackled numerous issues in the banking industry, so why not in the accommodation and travel industry?

By

Michael Holland-Nell

Senior Sales Manager at IDnow

Connect with Michael on LinkedIn

Hotel fraud in the hospitality industry.