In November 2022, the European Banking Authority issued its guidelines for the use of remote entry solutions in the banking and financial sector. High-level or substantial identification schemes and qualified electronic signature solutions took the spotlight. So what’s the difference between these two solutions? How do you choose? PVID vs QES: Which solutions are best for banking and financial relationships?

A changing regulatory environment: an overview.

The six requirements of the Monetary and Financial Code.

Article L.561-2 of the French Monetary and Financial Code (Code monétaire et financier) sets out six means of customer identification, to ensure that the customer enters into a remote relationship in complete confidence. The banking establishment must apply at least two of these measures (generally number 1 plus another complementary measure) in order to comply with local anti-money laundering directives.

European Banking Association recommendations.

Since October 2, 2023, the European Banking Association (EBA) has been recommending the use of solutions such as qualified electronic signatures and substantial or high-level identification schemes, such as PVID, in order to strengthen the fight against fraud when entering into a relationship.

The position of the AMF and ACPR in France.

In line with the EBA’s recommendations, the authorities that regulate the French financial market, Autorité des marchés financiers (AMF) and L’Autorité de contrôle prudentiel et de (ACPR), point out the vulnerabilities notably linked to the first installment in the fight against fraud. However, this third measure remains compliant, and is often perceived as less burdensome in terms of user experience, and simpler for regulated institutions to implement, than the measures outlined by the EBA.

Focus on complementary entry methods.

Following the EBA’s recommendations, solutions such as qualified electronic signatures and substantial or high-level identification schemes like PVID are favored by regulators when it comes to guaranteeing a more secure entry into the relationship. But what exactly does this mean? Let’s take a closer look.

Qualified electronic signature.

The Qualified Electronic Signature (QES) offers the highest level of security and guarantee of all electronic signatures. It reliably identifies the signatory and protects it against falsification or alteration. It uses a qualified certificate issued by a certified supplier and it is a particularly robust solution from an anti-fraud point-of-view, and inclusive from a user experience point-of-view.

How does the solution work?

- The user takes a picture of his or her identity document

- The user’s face is then captured on video

- Finally, the user signs his or her contract electronically

PVID certified by ANSSI.

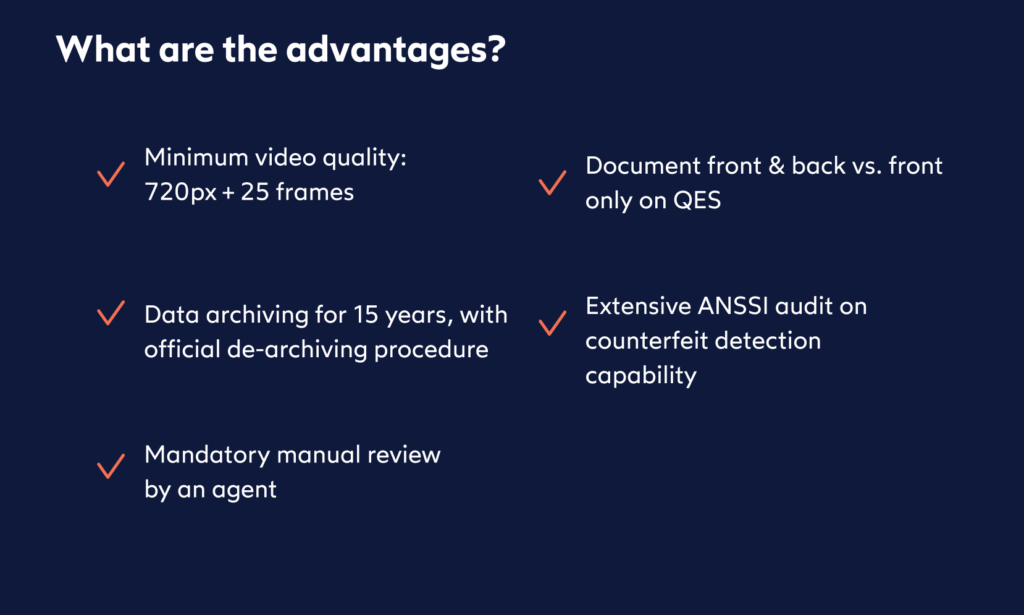

In March 2021, ANSSI issued a set of requirements for Remote Identity Verification Service Providers (PVID). The aim of this certification is to create a uniform, trusted service offering for identity verification providers. This solution is built for security, and is designed to limit identity fraud and advanced forgery.

How does the solution work?

- The user takes a video capture of his or her document and face.

- These captures are then automatically and manually verified by an agent specialized in document and identity fraud.

- A file of evidence is built up, and a verdict is reached on the authenticity of these captures and on the identity of the person concerned.

Financial operators need to strike the right balance between having a system that filters out as many fraud attempts as possible, while letting legitimate customers through.

Baptiste Forestier – Head of Compliance & DPO at Hero

The choice of solution: PVID vs QES.

To strike the right balance, both PVID and Qualified Electronic Signature (QES) offer substantial advantages, as mentioned above.

IDnow is one of the few certified providers of both electronic signature and identity verification solutions who can help you achieve compliance.

Our qualified e-signature solution boasts broad geographical coverage and an easy-to-use workflow, while meeting the main needs of today’s financial players: compliance, fraud prevention and an optimized customer experience.

To learn more about PVID check out our additional blogs: Why you should choose a PVID-certified identity verification provider as well as Unpacking PVID and the double-edged sword of technology, with Baptiste Forestier.

By

Mallaury Marie

Content Manager at IDnow

Connect with Mallaury on LinkedIn