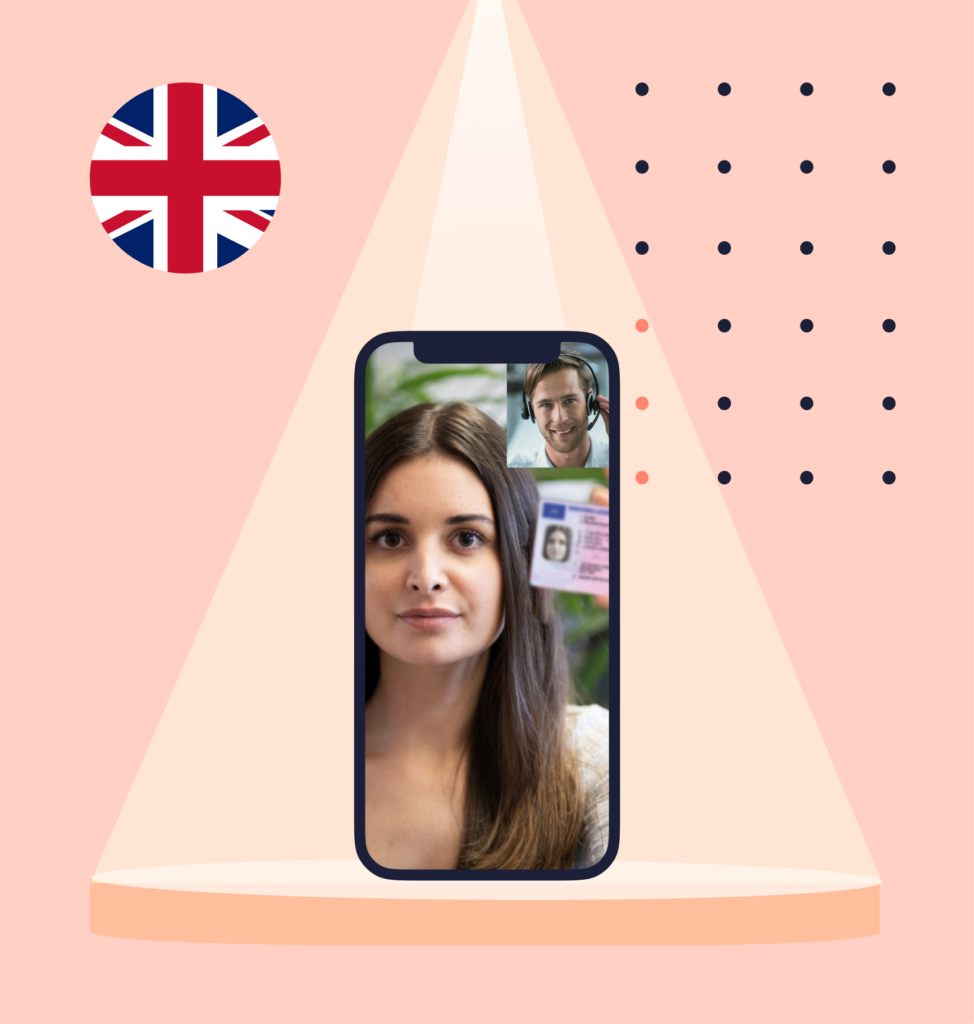

In an increasingly branchless, AI-automated world, offer your customers the face-to-face experience they deserve.

Technology – it gives with one hand and takes with the other.

Technology, and the internet in particular, has afforded consumers incredible convenience, providing 24/7 access to services, across every industry imaginable. Unfortunately, technology has also empowered criminals to commit fraud with an effortless ease and at an unprecedented level.

Discover more about the scourge of fraud in the UK, in our blog, ‘UK fraud strategy declares war on fraud, calls on tech giants to join the fight.’

On average, multinational banks are subjected to tens of thousands of fraud attacks every single month, ranging from account takeover fraud all the way to money laundering. It is this reason, among many others, that it’s paramount to verify the identity of customers as a preventative measure against fraud.

As businesses scale and the need to onboard customers increases, many banks have implemented AI-assisted automated identity verification solutions. In certain high-risk circumstances, however, the importance of human oversight cannot be overstated.

As bank branches continue to close (almost three-fifths of the UK’s bank network closing since 2015), many UK banks are beginning to look for alternatives to data checks and automatic checks and are turning to expert-led video verification solutions.

Plus, in light of increasingly stringent regulations, it’s more important than ever to ensure banks are doing all they can do protect their customers from fraud. Read ‘Banks urged to step up anti-fraud controls as APP scam compensation becomes compulsory.’

UK Fraud Awareness Report

Our recently launched VideoIdent Flex, specially designed for the UK market, works in two ways: full service or self-service, meaning banks can choose to either use our extensive team of multilingual identity experts, or have their bank staff trained to the highest standard of fraud prevention experts. Here’s how VideoIdent Flex can help.

Tackling fraud, in all 4 forms.

At IDnow, we categorize fraud into four different buckets. Here’s how VideoIdent Flex can help tackle fraud, in all its forms.

1. Fake ID fraud.

We classify fake ID fraud as the use of forged documents or fraudulent manipulations of documents. Common types of document fraud – the act of creating, altering or using false or genuine documents, with the intent to deceive or pass specific controls – include:

- Counterfeit documents: reproduction of an official document without the proper authorization from the relevant authority.

- Forged documents: deliberate alteration of a genuine document in order to add, delete or modify information, while passing it off as genuine. Forged documents can include photo substitution, page substitution, data alteration, attack on the visas or entry/exit stamp.

- Fantasy or camouflage documents: replicates codes from official documents, such as passports, driver’s licenses or national identity cards.

How VideoIdent Flex identifies and stops fake ID fraud.

As a first step, IDnow’s powerful automated checks can detect damaged documents, invalid/cut corners, photocopies and much more. As a second step and additional layer of assurance, identity experts, specially trained in fraud prevention request document owners to cover or bend certain parts of documents as a way of detecting fake IDs and document deepfakes.

2. Identity theft fraud.

Identity theft fraud is when individuals, without permission, use stolen, found or given identity documents, or when another person pretends to be another person. Although popular among teenagers to buy age-restricted goods like alcohol and tobacco, fake IDs are also used for more serious crime like human trafficking and identity theft. There are numerous forms of identity theft, with perhaps the darkest being ‘ghosting fraud’.

Discover more about the fraudulent use of a deceased person’s personal information in our blog, ‘Ghosting fraud: Are you doing business with the dead?’

How VideoIdent Flex identifies and stops identity theft fraud.

IDnow’s identity verification always begins with powerful automated identity checks of document data. Our identity specialists will then perform interactive motion detection tests like a hand movement challenge to detect deepfakes. To prevent cases of account takeover, VideoIdent Flex can be used to help customers reverify their identity when any changes to accounts (address, email etc) are made.

3. Social engineering fraud.

Worryingly, according to our recently published UK Fraud Awareness Report, more than half of Brits (54%) do not know what social engineering is. Social engineering fraud refers to the use of deception to manipulate individuals into divulging personal information, money or property and is an incredibly prevalent problem. Common examples of social engineering fraud include social media fraud and romance scams.

How VideoIdent Flex identifies and stops identity theft fraud.

To help prevent social engineering, in all its forms, our identity experts ask a series of questions specifically designed to identify whether someone has fallen victim to a social engineering scam. There are three different levels of questions: Basic; Advanced; and Premium, with questions ranging from “Has anyone promised you anything in return (money, loan etc) in return for this identification?” to “Has anyone prepared you for this identification?”

4. Money mules.

Although many may initially envisage somebody being stopped at the airport with a suitcase full of cash, money mules, like every fraudulent activity, has gone digital, and has now been extended to persons who receive money from a third party in order to transfer it to someone else. It is important to distinguish between “money mules” and “social engineering“. Money mules are involved in fraud scenarios (i.e. bank drops) and cooperate as part of the criminal scheme.

In a social engineering scenario, a person is seen as a victim of fraud and are usually unaware that they are breaking the law with their behaviour. They are tricked into opening accounts, e.g. through job advertisements.

How VideoIdent Flex identifies and stops money mule fraud.

Our fraud prevention tools like IP address collection and red flag alerts of suspicious combinations of data, such as email domains, phone numbers and submitted documents, can go some way to help prevent money mule fraud. However, as an additional safeguard, when combined with VideoIdent Flex, agents can be trained to pick up on suspicious social cues and pose certain questions.

The benefits of expert-assisted onboarding.

The onboarding stage is arguably the most important touch point that a bank has with its customers. It’s also the touchpoint that many businesses rush through.

Of course, speed of onboarding, which tends to be achieved via automated identity verification, is of paramount in most cases and for many users, however, in cases where customers face accessibility challenges, prefer a personal service, or are dealing with high-risk or high-value transactions, expert-led verification can offer an additional layer of protection and a VIP experience.

Expert-led video verification can build trust during onboarding and across the customer journey. It begins by providing a personalized and exclusive expert-led verification during onboarding, which can set brands apart and act as a powerful competitive differentiator. As a personalized face-to-face interaction helps guide customers through the process, it can prevent dropouts and maximize acceptance rates and conversions for high-value transactions.

The final and perhaps more important benefit that expert-led identity verification can provide is enhancing accessibility and inclusivity. For vulnerable and less tech-savvy members of society, such as the elderly, or vision or hearing impaired, expert-led identity verification provides a great way to onboard.

Learn more about the role of technology in providing an inclusive and accessible world, especially for identity verification, in our blog, ‘Do identification services have an identity crisis?’

Expert-led video verification helps organizations improve inclusivity, accessibility, safety, and convenience for all. Our specially trained agents can help your most vulnerable customers and ensure they don’t miss out on the services they deserve.

Why video identity verification is an indispensable fraud-prevention tool.

Check out our interview with our Principal Product Manager, Nitesh Nahta and Senior Product Marketing Manager, Suzy Thomas to discover more about how expert-led video identity verification product, VideoIdent Flex can be used to boost customer conversion rates, reduce rising fraud attempts, and tackle an array of complex online verification scenarios and inclusivity and accessibility challenges.

Learn more about Brits’ awareness of the latest fraud terms, the industries most susceptible to fraud and usage of risky channels, by reading our ‘What the UK really knows about fraud’ blog and ‘The role of identity verification in the UK’s fight against fraud’

Or, interested in how fraud trends and fraud prevention has changed over the years, read our interview with ex CID officer, Paul Taylor.

Discover the benefits of KYC in the banking sector.

By

Jody Houton

Senior Content Manager at IDnow

Connect with Jody on LinkedIn