What is KYC?

KYC means “Know Your Customer.” It describes the process of verifying the identity of customers – either before or during the start of doing business with them. The KYC process is performed to prevent illegal activities such as money laundering or fraud, in return protecting both company and client.

All you need to know

about KYC

Step up your KYC game

How can we help?

As there is no one KYC Process, what it really comes down to is knowing the needs of your institution and complying with regulations, but don’t worry because IDnow is here to assist in finding the right solution just for you.

Learn in a first chat with one of our experts how the IDnow Proofing Platform enables you to get your KYC process up and running!

Get in touch with us

Why does KYC matter?

The extensive use of new technologies and the internet makes it necessary to define standards that help fight online fraud e.g.

- Money Laundering

- Terror Financing

- Corruption

The KYC procedure responds to a legal and global imperative for any type of business that wants to onboard a user as a client and know that they are trustworthy.

How does KYC work?

The KYC process consists in verifying that the client is actually who he says he is and giving him access to the services or products he needs. This verification is carried out through different methods, although not all comply with legal requirements.

What are the three components of KYC?

- Customer Identification Program (CIP): The customer is who they say they are

- Customer Due Diligence (CDD): Assess the customer’s level of risk, including reviewing the beneficial owners of a company

- Continuous monitoring: Check client transaction patterns and report suspicious activity on an ongoing basis

The advantages of a robust KYC process

In an increasingly global economy, financial institutions are more vulnerable to illicit criminal activities. Know Your Customer (KYC) standards are designed to protect financial institutions against fraud, corruption, money laundering and terrorist financing.

Cost efficient.

Benefit from increased conversion rates and optimized customer acquisition costs.

Convenient & Effortless.

Grant instant access once verified, avoiding any friction or difficulty between business and users.

Connected & Complete.

Identify users at anytime, from anywhere. Go beyond the basic ID and benefit from a more complete identity.

Fully compliant.

Store identities and credentials with all levels of assurances (LOA). Customize your solutions while meeting all regulatory requirements without needing to go elsewhere.

Who needs KYC?

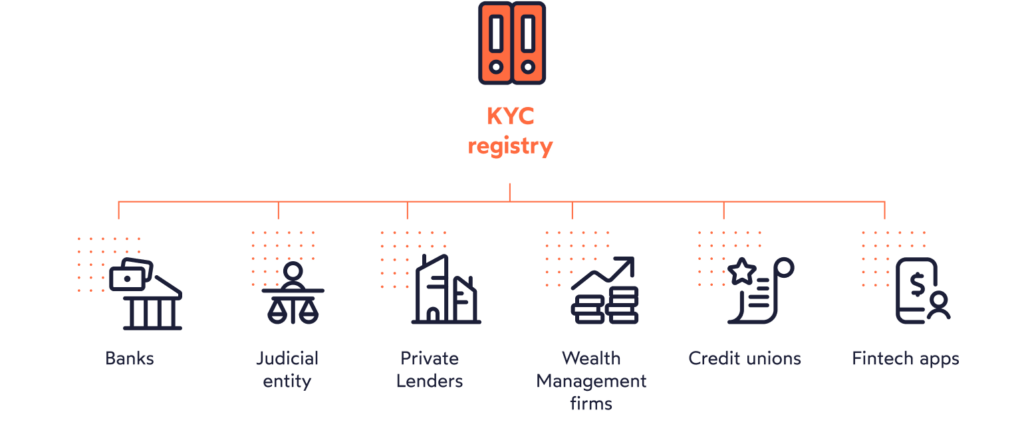

KYC is required for financial institutions that deal with customers during the opening and maintaining of accounts.

When a business onboards a new client, or when a current client acquires a regulated product, standard KYC procedures generally apply.

KYC regulations

KYC regulations have become an increasingly critical issue for almost any institution that interacts with money (so, just about every business):

- Banks

- Credit unions

- Wealth management firms and broker-dealers

- Finance tech applications (fintech apps), depending on the activities in which they engage

- Private lenders and lending platforms

While banks are required to comply with KYC to limit fraud, they also pass down that requirement to those organizations with whom they do business.

All the important FAQ

about KYC

What are the requirements for KYC?

The two basic mandatory KYC documents are proof of identity with a photograph and a proof of address. These are required to establish one’s identity at the time of opening an account, such as a savings account, fixed deposit, mutual fund and insurance.

How much does KYC cost?

Financial institutions have reported spending $60 million annually, based on research conducted by Consult Hyperion in 2017. Some are even spending up to $500 million each year on KYC, according to a 2016 Thomson Reuters survey.

What triggers KYC?

Triggers for KYC can include:

Unusual transaction activity

New information or changes to the client

Change in the client’s occupation

Change in the nature of a client’s business

Adding new parties to an account

What Are KYC Documents?

Requirements vary in different jurisdictions. However, account owners generally must provide a government-issued ID as proof of identity. Some institutions require two forms of ID, such as a driver’s license, birth certificate, social security card or passport. In addition to confirming identity, the address must be validated. This can be done with proof of ID or with an accompanying document verifying the address on record.

What’s the difference between AML and KYC?

The difference between AML (anti-money laundering) and KYC (Know Your Customer) is that AML refers to the framework of legislation and regulation that financial institutions must follow to prevent money laundering. KYC is more specific and relates to verifying a customer’s identity, which is a key part of the overall AML framework.

Are IDnow’s KYC solutions compliant with my regulation?

IDnow offers the right solution for many markets and use cases. In addition to the BaFin from Germany and the FMA from Austria, IDnow also provides compliant solutions for all other EU markets.

IDnow & KYC

How IDnow helps with KYC processes

Effective KYC processes are the backbone of any successful compliance and risk management programme, and the demands of meeting KYC obligations are intensifying.