Document capture enhanced with eID/NFC

Cross-check the verification of identities by matching information in photo ID documents with submitted identity data via chip identity cards or NFC-readout.

Compliant. Convenient. Innovative POS solutions.

IDnow’s in-store Point of Sale (POS) identity verification solution is revolutionizing the way businesses confirm identities in real time. Whether it’s for signing contracts, activating accounts, or verifying high-value transactions, IDnow empowers your team to deliver fast, reliable and hassle-free in-person verification.

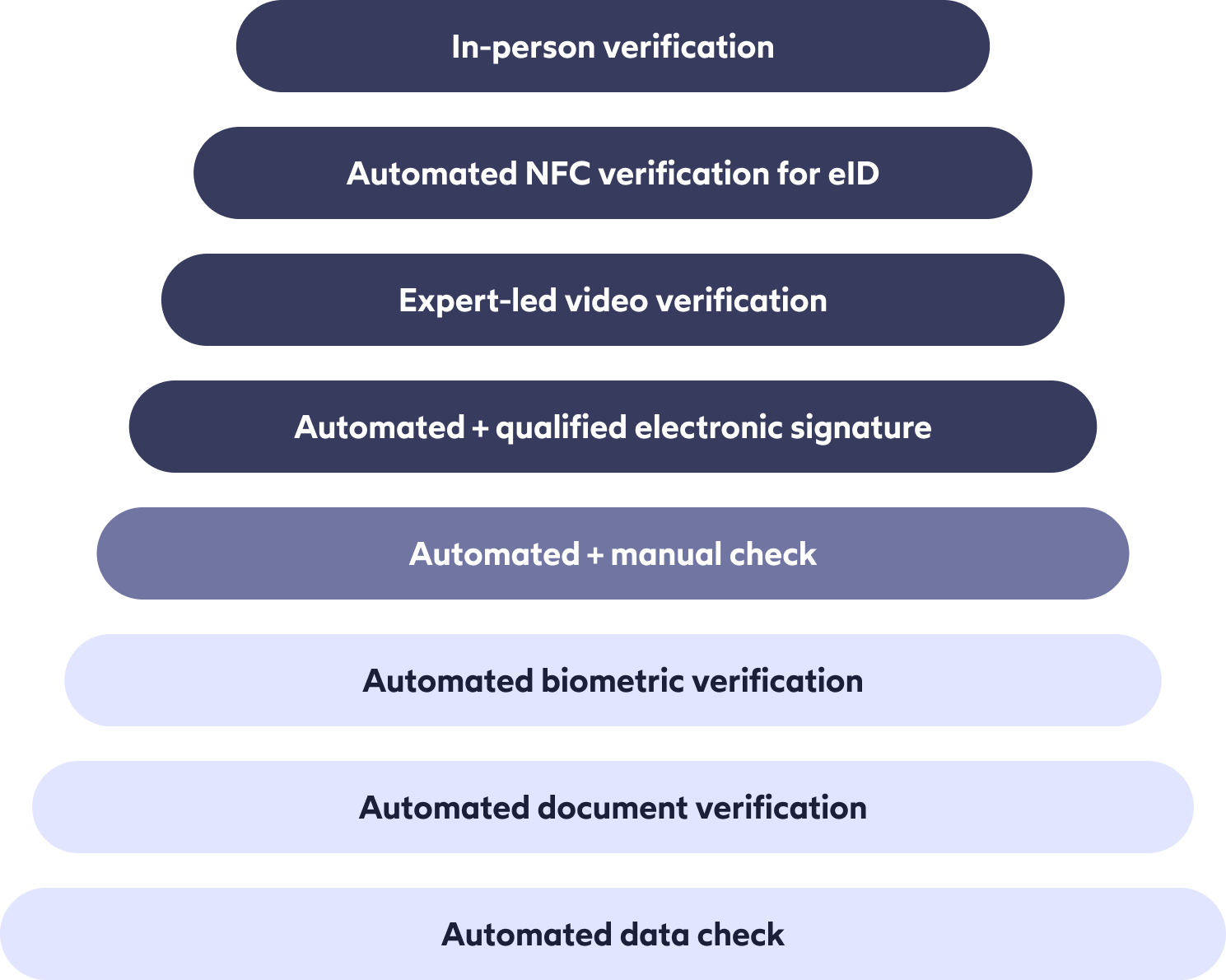

MULTI-LAYERED APPROACH

Add additional layers of assurance and scale according to your risk appetite and regulatory requirements to achieve compliant, scalable and holistic identity verification.

The speed of the process helped us enormously in making our onboarding process and our service scalable. Moreover, we were able to reduce the operational workload on our back-office team. It is important to us that identification is secure for us and our customers. We work with sensitive data and were looking for a partner we could trust, with security expertise, and knowledge of regulatory requirements and the divergent legislative situations.

Jari Hautaranta | Customer Due Diligence Manager | Holvi

We are delighted to extend IDnow AutoIdent’s trusted identity verification service to our business partners and members to further encourage an environment where ambitious job seekers can build credibility and employers can make hiring decisions they can rely upon. The addition of the new Identity TrueProof strengthens our commitment to future-proofing our verifications and enabling our members to utilize their verified documents throughout their professional lives, building trust and integrity wherever their careers may take them.

René Seifert | Chief Digital Officer | The DataFlow Group

We are happy to work with IDnow in the rapidly growing identity market. The products are a great addition to our portfolio and enable us to support digital processes in various regulatory areas. We work closely with the dedicated Partner Sales Team at IDnow. They consistently provide us with their deep understanding of the market dynamics and different regulatory environments so we can not only sell a great solution but also guarantee excellent service, at any time. IDnow shares our aspiration to deliver the highest quality product and service.

Martin Honegger | Director Business Development | Intrum AG

Comply with global regulations.

Keep customers’ accounts and data safe.

Cross-check the verification of identities by matching information in photo ID documents with submitted identity data via chip identity cards or NFC-readout.

State-of-the-art hardware combined with biometric verification ensures compliance with the German Money Laundering Act (GwG), the Telecommunications Act (TKG) and eIDAS 2.0.

Provide your customers with a premium high-touch, in-person identity verification experience that doesn’t compromise on the speed and convenience of a digital solution.

Instant in-store verification provides a barrier-free and more inclusive and accessible identity verification experience for all.

In-person identification provides unparalleled assurance by combining physical biometrics with state-of-the-art hardware to ensure the highest level of security and trust in authentication processes.

Immediate results

Immediate results In-store identity verification

In-store identity verificationEmpower your customers to verify their identity and open bank accounts in-store.

Learn moreVerify identities in an instant to activate prepaid SIM cards.

Learn more