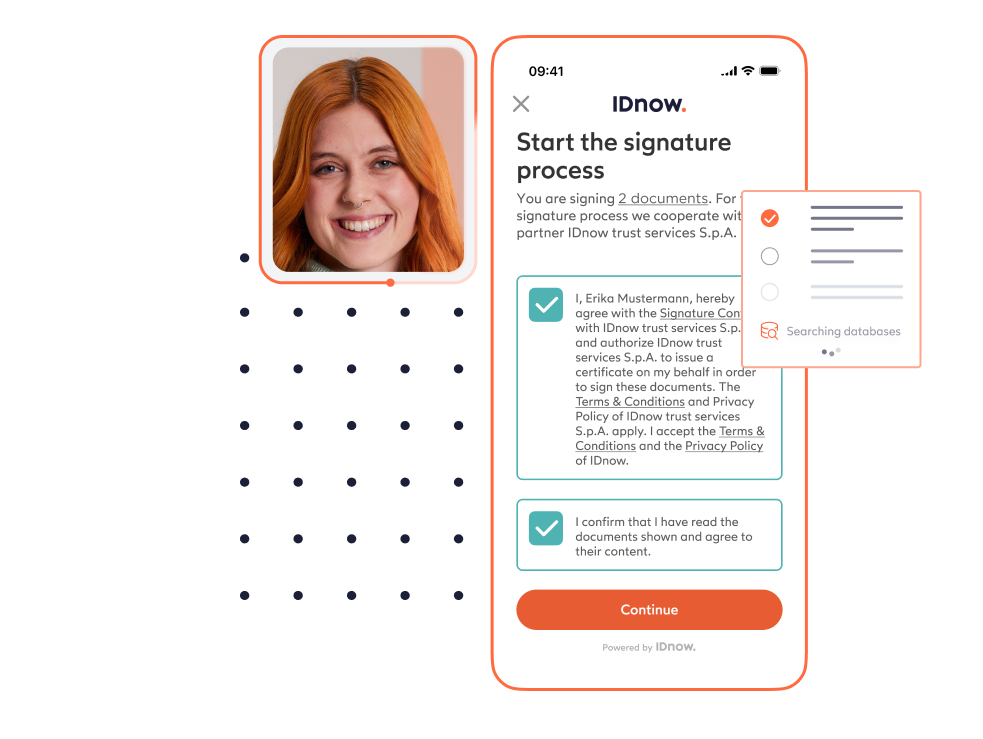

Know your customers. Sign in seconds.

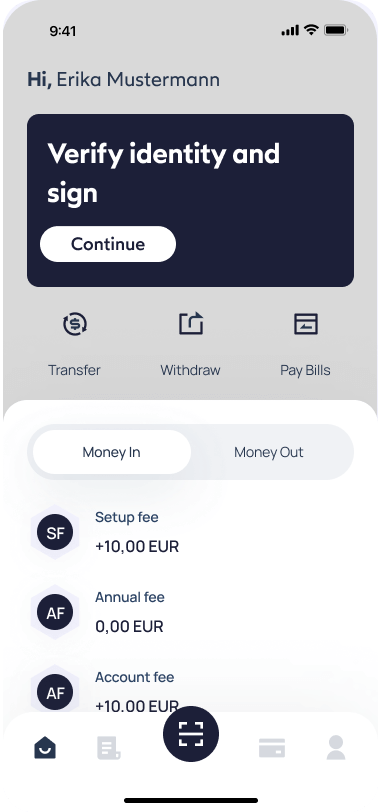

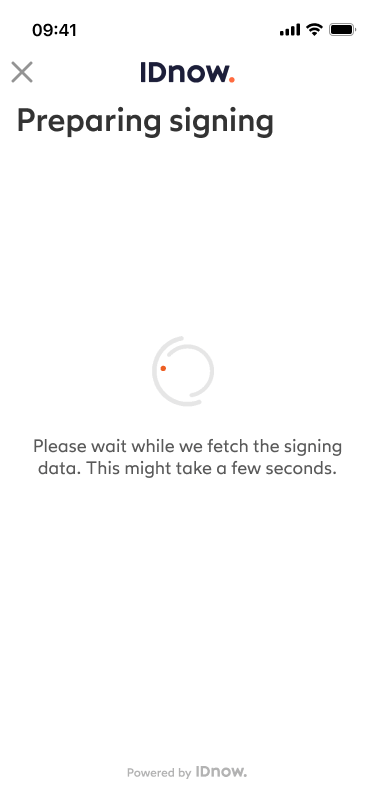

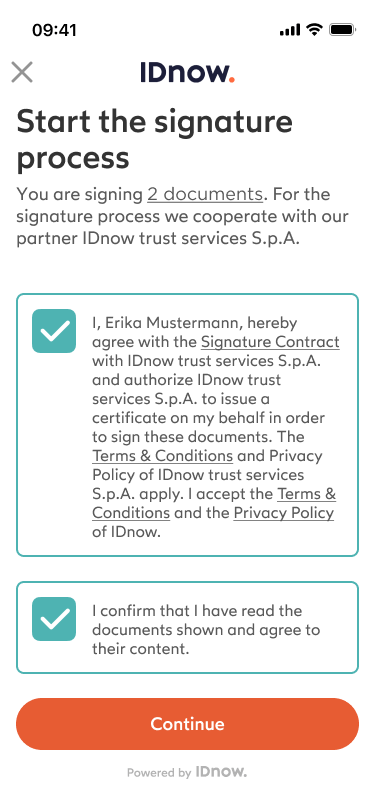

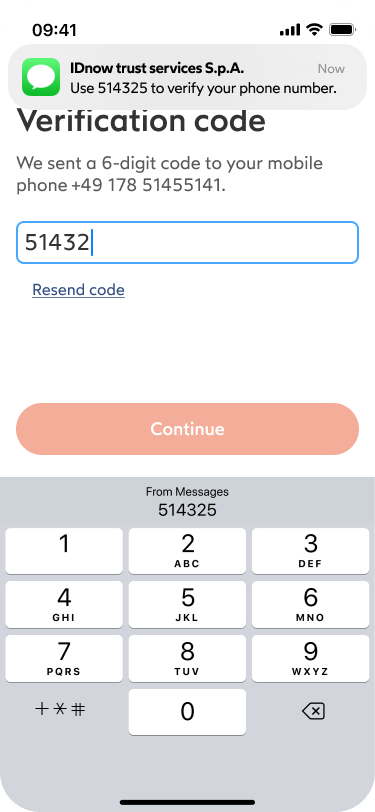

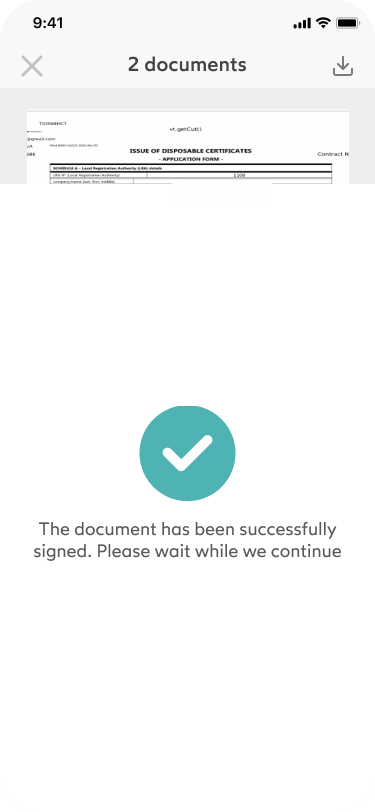

Experience the convenience of IDnow’s InstantSign, which eliminates the need for repetitive identity verification before issuing a Qualified Electronic Signature (QES). Unlike other signing solutions that require a new verification for each transaction, InstantSign allows businesses to leverage the AML-compliant identity verification already completed during onboarding.

This means your customers can digitally sign contracts seamlessly and effortlessly, with no additional integrations required, all while remaining fully compliant with eIDAS regulations. Simplify your signing process and enhance customer satisfaction with IDnow InstantSign.